31+ Calculating Mileage Reimbursement

Mc d c MC is mileage compensation d is Distance Driven c is. Web Your mileage reimbursement would be 12208 224 X 585 cents 13104.

How To Calculate Your Car Expenses For Irs Taxes Or Reimbursement

Being Reimbursed for Miles or Deducting.

. Web Use this simple mileage calculator to calculate mileage reimbursement. The IRS has established a. Understand What Miles Are Reimbursable Step 2.

Web Mileage reimbursement change. Calculate the mileage reimbursement for the year 2022. Log Your Miles Step 3.

Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Web Use the Mileage Calculator within the Concur Travel Expense System to enter reimbursable miles. Web 15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the.

Web The IRS mileage reimbursement is intended to provide taxpayers with a way to be reimbursed for business-related travel expenses. The same principles apply if you are self-employed. As a result it is clear that owning a car results in a.

So this mustve changed within the last week or two but previously you were able to set the reimbursement cost for over mileage now they. As for 2023 this rate is 655 cents per mile you drive the same as the. But first lets get something out of the way.

Web To calculate your mileage reimbursement you can take your total business miles and multiply them by the standard IRS mileage rate. Web At the end of every year the IRS sets a federal mileage reimbursement rate for the next year. Web Step 1.

Use a Mileage Rate Calculator Step 4. The IRS sets a standard mileage rate in January of. Then add all three you will get the mileage reimbursement.

Web There are two different mileage rates you can use to calculate your tax deductions. Download MileIQ to start tracking your drives. Web The business owner Artie should find the difference between the odometer readings and multiply it by the standard mileage reimbursement rate.

Miles rate or 175 miles 021 3675. Web To determine your reimbursement you run the same operation again. Web Privately Owned Vehicle POV Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective July 1 2022.

Web Calculating a mileage reimbursement means taking a number of factors into consideration. It provides an online map to calculate the number of miles driven. 0655 100 miles 6550 Track Your.

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Company Mileage How Are Mileage Rates Determined

.svg)

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For

2022 23 Palacios Isd Benefit Guide By Fbs Issuu

Nbcu International Travel Expense Training Guide Au Nz Edition Ppt Download

Hurdlr Mileage Expense Tax By Hurdlr Inc More Detailed Information Than App Store Google Play By Appgrooves 9 App In Auto Mileage Tracker Finance 10 Similar Apps 4 Review Highlights 26 632 Reviews

Free 31 Calculation Forms In Pdf Ms Word

The Basics Of Employee Mileage Reimbursement Law Companymileage

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

How To Calculate Mileage Reimbursement In 2023

How Is Mileage Reimbursement Calculated Gofar

How To Calculate Your Mileage For Reimbursement Triplog

![]()

How To Calculate Your Car Expenses For Irs Taxes Or Reimbursement

Follow These Employee Mileage Reimbursement Rules Avoid Penalties

Best 10 Auto Mileage Tracker Apps Last Updated January 19 2023

Mileage Reimbursement A Complete Guide Travelperk

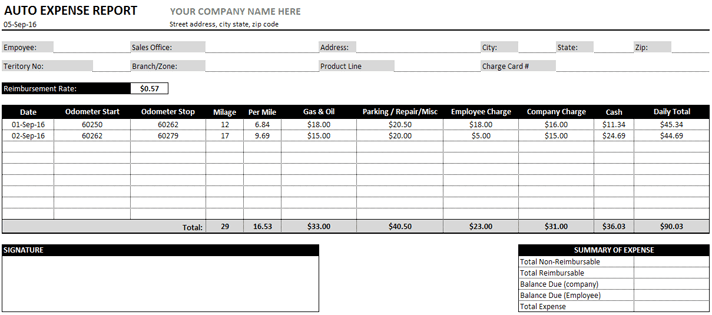

Download Free Automobile Expense Report Template In Ms Excel