19+ mortgage and taxes

Web Here is an overview of which mortgage costs might be tax deductible for you in 2023. The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with the.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Answer Simple Questions About Your Life And We Do The Rest.

. EST 2 Min Read. Web He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web 5 hours agoMarch 10 2023 528 pm.

These amounts include a New York state levy of. This is arguably the most critical step in the. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Web 1 day agoLets say your home loan is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 719 your monthly payment will be about 678. Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of.

Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file. Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total. Web 11 hours agoA mortgage lien is a legal claim a lender has to a property until the borrower pays off their mortgage.

Web A property tax is a tax assessed on real estate usually based on the value of the property you own and usually by your local or municipal government. Current IRS rules allow many homeowners to deduct. This will calculate just how much is being paid that can then be used as a tax.

The most obvious aspect lenders look at when reviewing tax returns is verifying income. Web Your Income and Assets. Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. In a 52-week span the lowest rate was 445 while the. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Tax treatment of COVID-19 homeowner relief payments clarified. Web Based on first-year interest costs for a 30-year fixed-rate mortgage at the current national average rate of 365. Homeowners who receive or benefit from payments from a federal homeowner.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. The government COVID-19 eviction moratorium has ended.

Use Form 1098 to report. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Web COVID-19 Rental Assistance.

Liens enable mortgage lenders to foreclose on borrowers. Is mortgage interest tax deductible. Web Check out the webs best free mortgage calculator to save money on your home loan today.

Find A Lender That Offers Great Service. Ad Compare the Best Home Loans for March 2023. You may request up to two additional three-month extensions up to a maximum of 18 months of total.

Homeowners who bought houses before. Estimate your monthly payments with PMI taxes homeowners insurance HOA. Ad More Veterans Than Ever are Buying with 0 Down.

Federal income tax status of a real estate mortgage investment conduit REMIC and an. Web Use a mortgage calculator designed specifically to tell you about the interest paid during a loan. Web If your mortgage is backed by Fannie Mae or Freddie Mac.

Web The Homeowner Assistance Fund was established by the American Rescue Plan Act to help homeowners who have been financially impacted by COVID-19 with. Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize. Estimate Your Monthly Payment Today.

Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Compare More Than Just Rates. Web Discount Points Deductions.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. Web Angel Oak Home Loans uses the income from 1099 earning statements to determine how much house you can afford. Web As discussed further below the guidance generally clarifies that the US.

Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week. Apply Get Pre-Approved Today. Lock Your Rate Today.

The table above shows that if youre single. This means you wont have to provide your. Landlords now have the ability to evict renters who are not able.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Trainee Conveyancers At Start Real Estate Academy January 2023 Chadwick Lawrence

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Writing A Subject Free Offer Dustan Woodhouse Mortgage Expert

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Cfpb Reminds Lenders To Have A Clear Reconsideration Of Value Process Mckissock Learning

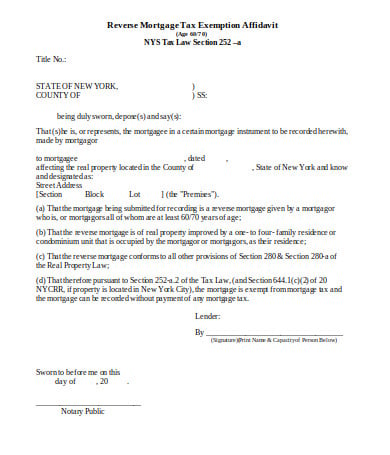

11 Reverse Mortgage Templates In Pdf Doc

Virtuous Tax And Financial Home

Home Mortgage Interest Deduction Calculator

End The Mortgage Interest Deduction Expect A Fight

Tax Debts Mortgages Should I Use Mortgage For Tax Debts

Home Mortgage Interest Deduction Calculator

Bc Mortgage Survey 2021 How Low Interest Rates Affect Existing Prospective Homeowners The Help Hub

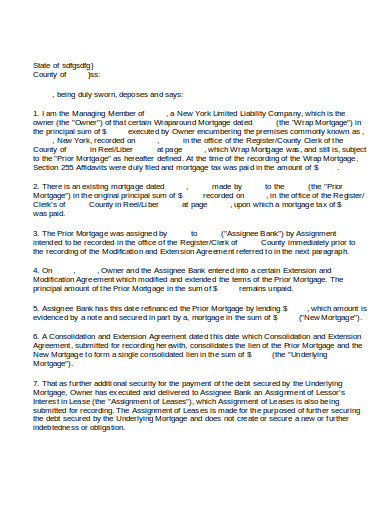

10 Wraparound Mortgage Templates In Doc Pdf

Mortgage Tax Savings Calculator

Mitchells Grievson Chartered Accountants Mitchellsgrievs Twitter

Buy A Business Begin A Dream

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset